Why Financial Stress and Anxiety Quietly Drain Your Sanity

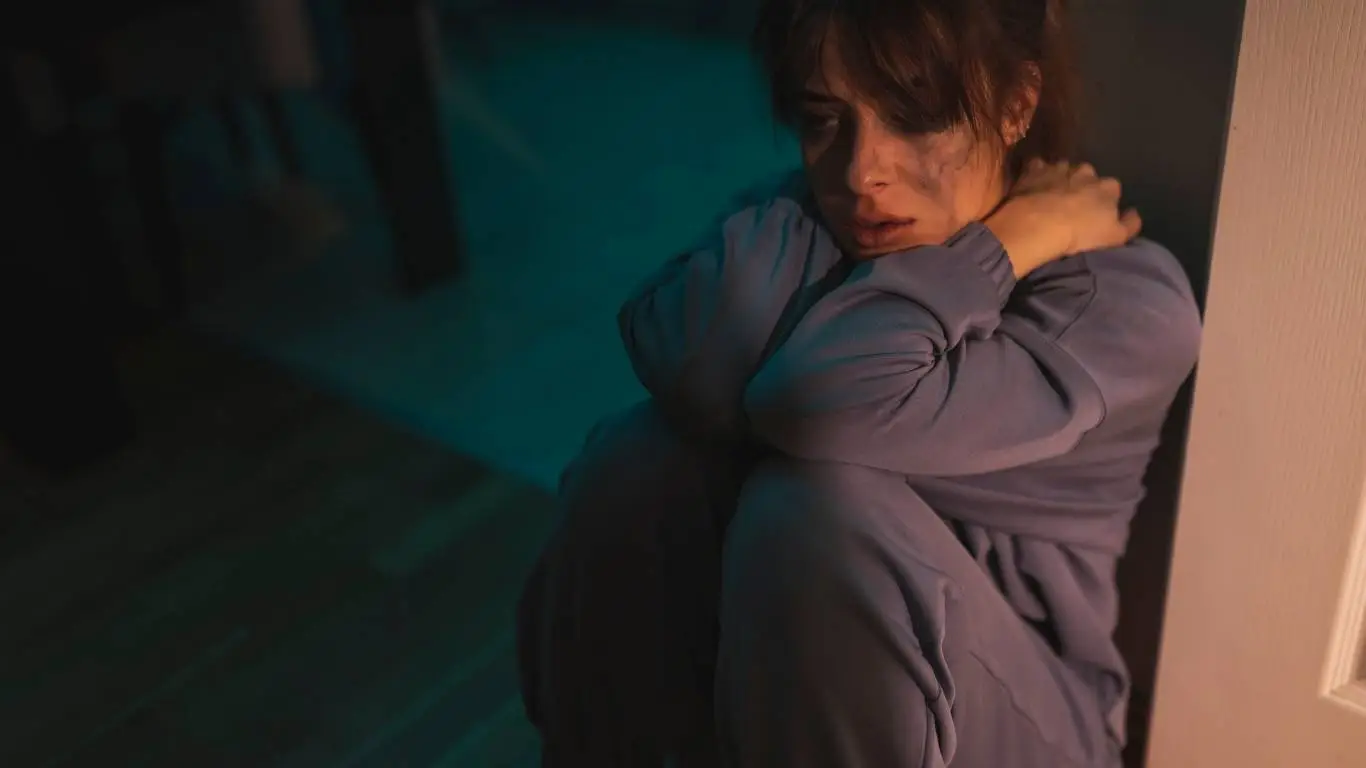

Not long ago, I found myself lying awake at 3 a.m., staring at the ceiling fan, calculating bills and deadlines like some kind of twisted bedtime math. That’s when it really hit me—financial stress and anxiety weren’t just temporary worries. They were deeply rooted, persistent, and, frankly, exhausting. And I know I’m not alone. In fact, it’s one of the quietest epidemics eating away at mental well-being for millions.

Why Financial Anxiety Feels Like It Never Leaves

Money anxiety doesn’t always announce itself with sirens. It creeps in silently—during grocery shopping, when checking your bank balance, or while pretending everything is fine at work. Unlike occasional stress, financial anxiety loops you into a constant fight-or-flight cycle, making it tough to relax or think clearly.

Some telltale signs include:

- Feeling on edge when checking your finances

- Avoiding financial conversations (even with yourself)

- Procrastinating on bills or budgeting out of fear

- Physical symptoms like headaches, insomnia, or chest tightness

What makes this even more challenging is that most of us don’t want to admit that we’re financially stressed. We internalize it. It gets buried under shame, guilt, and even comparisons to people who seem to have it all figured out.

The Psychology Behind the Panic

Here’s the raw truth: money worries trigger the same brain pathways as other forms of anxiety. Your amygdala (the brain’s alarm system) kicks in, flooding your body with cortisol, and suddenly you’re not thinking about solutions—you’re just trying to survive.

Over time, chronic financial stress can lead to more entrenched issues like:

- Shortness of breath during panic spikes

- Chest tightness and palpitations

- Obsessive financial thoughts that feel uncontrollable

- Heightened risk of clinical anxiety disorders

As someone who once avoided checking my bank app for two straight months (yes, months), I can tell you it never helps. Avoidance feeds anxiety. Facing it—gently, gradually, with support—is the only way forward.

How Financial Anxiety Shows Up in Everyday Life

The thing about financial anxiety is that it doesn’t just stay in your wallet—it seeps into your job, relationships, sleep, and health. If you’ve ever snapped at your partner over a $12 expense or lost sleep over a late fee, you’ve felt the grip of it firsthand.

Work Performance Takes a Hit

When you’re preoccupied with bills, it’s hard to focus. Anxiety sabotages productivity and creativity, and before you know it, you’re underperforming, which leads to—you guessed it—more financial pressure.

Relationships Start to Strain

Money talk can be a minefield in relationships. Whether you’re single, dating, or married, financial stress can trigger resentment, secrecy, and emotional distance. I’ve seen it unravel the best of intentions in otherwise solid partnerships.

Physical Symptoms Amplify

Your body keeps score. And when you’re living in a near-constant state of panic about money, it shows up physically. Think insomnia, headaches, digestive issues, and fatigue.

Tools That Have Actually Helped (From Personal Trial-and-Error)

I’ve tried a lot of things. Some felt gimmicky, others stuck. These were game changers for me:

- Mindful Budgeting – I stopped using spreadsheets like a corporate accountant and started journaling my spending. Every expense got a note on why I made that purchase.

- Therapy – I went in for general anxiety and realized my biggest trigger was money. Psychodynamic therapy helped me untangle childhood money beliefs that were still running the show.

- CBT Techniques – Reframing catastrophic thoughts like “I’ll end up homeless” into something more rational. I found this guide helpful: CBT steps that actually work.

- Grounding Practices – When I felt overwhelmed, I’d do simple breathing exercises or muscle relaxation. Sounds cliché, but they work when you’re spiraling.

When Financial Stress Turns Into Something Bigger

For some, financial anxiety becomes the gateway to deeper mental health struggles. If your anxiety is persistent, intense, or interfering with daily life, it may be time to explore clinical support options like diagnostic assessments for anxiety disorders.

You might also benefit from exploring broader frameworks on psychotherapy for anxiety, especially if stress is affecting your relationships or identity. If this feels familiar, it’s not just you—and you’re not imagining it.

For more context on how anxiety disorders deeply entangle with everyday routines, this article offers a great breakdown from the larger mental health lens.

Financial anxiety is real, complex, and way more common than most of us admit. But it’s also something we can name, address, and loosen its grip—with the right tools, support, and compassion for ourselves along the way.

Breaking the Shame Cycle Around Financial Anxiety

If I could pinpoint the most toxic part of financial anxiety, it’s the shame spiral. You start with stress over money, then blame yourself for not having more, for making past mistakes, for not being “smart enough” about budgeting. It’s isolating, and it’s also wildly unproductive. The thing is, financial anxiety thrives in silence. Talking about it is a form of rebellion—and healing.

Opening up to a friend helped me shift my mindset. Instead of “I’m bad with money,” I began reframing it to “I’m learning how to work with money.” It sounds small, but that one shift quieted a lot of inner noise.

Rethinking What ‘Financial Wellness’ Actually Means

The financial world loves throwing out words like “wellness” and “freedom” as if they’re finish lines. In reality, mental wellness around money is less about how much you earn and more about how safe you feel managing what you have.

There’s nothing wrong with striving to improve your income. But wellness is also:

- Knowing where your money goes—without panicking

- Setting boundaries around lifestyle inflation and impulse spending

- Not equating your worth with your net worth

- Feeling in control of the small stuff, even if the big picture isn’t perfect

Nutrition, Sleep, and the Anxiety Connection

What surprised me most was how strong the physical link between nutrition and anxiety is. I used to live on caffeine and skipped meals when I was anxious about money. Guess what? That only made things worse.

Once I cut back on caffeine and added magnesium-rich foods, it was like my nervous system finally got the memo to chill. Not a miracle cure, but a noticeable shift. These helped:

- Magnesium-rich foods like almonds and spinach

- Caffeine-free calming drinks

- Cutting back on hidden sugar

- Adding more omega-3s for brain function and mood

And let’s not skip the importance of sleep hygiene. When you’re financially anxious, sleep often becomes a casualty—but that creates a nasty loop. Better rest means better decisions and better emotional regulation. One simple habit that worked for me? Turning off financial apps and email alerts after 8 p.m.

Setting Financial Boundaries Without Feeling Guilty

One of the hardest things I had to learn: it’s okay to say “no” to things you can’t afford—even if they’re fun or meaningful. Social pressure, family expectations, or even self-imposed guilt can pull you into financial commitments that feed long-term anxiety.

Setting boundaries looked like this for me:

- Declining trips or outings when I hadn’t budgeted for them

- Being honest with friends about my goals

- Switching from “I can’t afford that” to “That’s not in my budget right now”

Relationship anxiety also shows up here. You don’t have to match your partner’s spending habits to prove love or stability. Financial anxiety becomes more manageable when your financial choices reflect your actual situation—not someone else’s expectations.

Using Digital Tools—But with Caution

Budgeting apps, debt trackers, and AI-powered tools can be amazing—until they’re not. I went through a phase of obsessively checking budgeting dashboards ten times a day. It backfired. Data is helpful, but constant financial self-monitoring can become a new stressor.

Instead, I now use tools with intention:

- Log in once a day, not hourly

- Set alerts for goals—not just for overspending

- Use notes features to track emotional context around expenses

There’s also a deeper layer here: understanding how digital behavior influences anxiety. Not every calming solution is digital. Sometimes, a pen-and-paper budget, or a real human coach or therapist, makes a bigger difference than another app notification.

When You Need More Than Budgeting Tips

If you’ve done all the “right” things and still feel like you’re drowning, you’re not weak—you’re just dealing with something that might need deeper support. There’s absolutely no shame in that. Professional counseling saved my mental health more than once, especially when money fears became linked to other life stressors.

Here’s when to consider seeking more structured help:

- You’re experiencing panic attacks related to finances

- Your anxiety is affecting your ability to function at work or socially

- You’ve developed physical symptoms (digestive issues, migraines, etc.)

- You find yourself obsessively thinking about worst-case financial scenarios

Proper diagnosis and understanding the full picture of what’s going on can be a turning point, not a label to fear.

You’re Not Just Stressed—You’re Human

Financial anxiety isn’t a flaw—it’s a signal. It tells you that something matters and something feels out of control. But it doesn’t mean you’re failing. In fact, naming it is one of the most powerful things you can do to start untangling it.

If this is something you’ve been silently carrying, maybe today’s the day to stop doing it alone. Whether you start journaling your spending, seek therapy, or just have a real talk with a friend—every step counts. Every single one.

For a deeper dive into related issues and holistic approaches to healing, explore our full guide on lifestyle self-help strategies for anxiety disorders. You can also view the broader context in our main anxiety disorders overview.

Camellia Wulansari is a dedicated Medical Assistant at a local clinic and a passionate health writer at Healthusias.com. With years of hands-on experience in patient care and a deep interest in preventive medicine, she bridges the gap between clinical knowledge and accessible health information. Camellia specializes in writing about digestive health, chronic conditions like GERD and hypertension, respiratory issues, and autoimmune diseases, aiming to empower readers with practical, easy-to-understand insights. When she’s not assisting patients or writing, you’ll find her enjoying quiet mornings with coffee and a medical journal in hand—or jamming to her favorite metal band, Lamb of God.